Cryptocurrency taxation in the US

Disclaimer: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

To begin, the most common factors affecting how cryptocurrencies are taxed in the US are as follows:

1. How long you've held the digital asset

2. Your income bracket

3. Whether you can employ tax-loss harvesting

1. How long you've held the digital asset

2. Your income bracket

3. Whether you can employ tax-loss harvesting

Table of Contents

- Crypto capital gains

- Tax loss harvesting

- Identifying lots

- What if I use my crypto to buy something? Do I still have to pay taxes?

- Is there a tax exemption for small crypto purchases in the US?

- What if I'm paid in crypto? How will I be taxed?

- Does trading one cryptocurrency for another cryptocurrency count as a taxable event?

- How does US tax law treat cryptocurrency airdrops?

- How does US tax law treat cryptocurrency forks?

- How does US tax law treat cryptocurrency staking?

- Is there software to help with crypto tax reporting?

Buy as little as $30 worth to get started

Related guides

Start from here →

How is cryptocurrency taxed?

Get the basics of how cryptocurrencies are taxed and what it means for you.

Read this article →

How is cryptocurrency taxed?

Get the basics of how cryptocurrencies are taxed and what it means for you.

Bitcoin.com in your inbox

A weekly rundown of the news that matters, plus educational resources and updates on products & services that support economic freedom

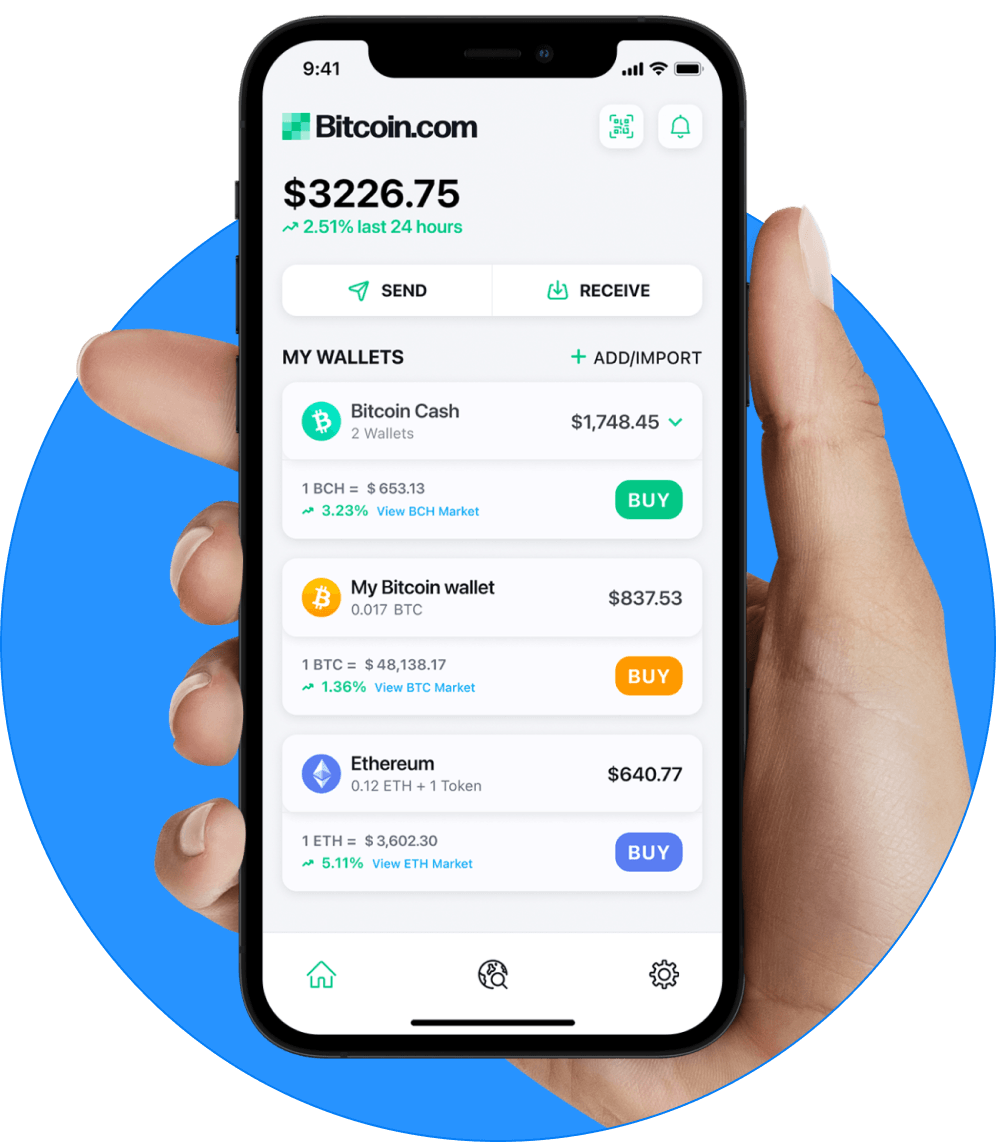

Start investing safely with the Bitcoin.com Wallet

Over wallets created so far

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely

Download now