How to provide liquidity on a DEX

This article covers information on the importance of liquidity and how to provide it with links to step-by-step instructions for Bitcoin.com’s Verse DEX using the Bitcoin.com Wallet app.

Buy as little as $30 worth to get started

Related guides

Start from here →

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

Read this article →

What is a DEX?

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party, or intermediary, to facilitate the exchange of cryptoassets.

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

Read this article →

What is DeFi?

Learn what makes decentralized finance (DeFi) apps work and how they compare to traditional financial products.

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

Read this article →

DeFi use cases

Decentralized Finance (DeFi) is bringing access to financial products to everyone. In this article we examine some prominent use cases.

DEX lingo

From AMM to yield farming, learn the key vocabulary you’ll encounter when trading on a DEX.

Read this article →

DEX lingo

From AMM to yield farming, learn the key vocabulary you’ll encounter when trading on a DEX.

What are crypto derivatives?

Derivatives like perpetual futures and options are widely used in crypto. Learn all about them.

Read this article →

What are crypto derivatives?

Derivatives like perpetual futures and options are widely used in crypto. Learn all about them.

What are prediction markets?

Find out about prediction markets, including how they work and what they are used for.

Read this article →

What are prediction markets?

Find out about prediction markets, including how they work and what they are used for.

Dollar-cost averaging

Learn how to protect yourself from big losses with this simple but powerful investment strategy.

Read this article →

Dollar-cost averaging

Learn how to protect yourself from big losses with this simple but powerful investment strategy.

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

Read this article →

What is APY?

APY stands for annual percentage yield. It is a way to calculate interest earned on an investment that includes the effects of compound interest.

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

Read this article →

What is liquidity?

Liquidity has several slightly different but interrelated meanings. For the purposes of crypto, liquidity most often refers to financial liquidity and market liquidity.

What is a token sale?

Token sales are an important part of the crypto ecosystem. Learn their ins and outs.

Read this article →

What is a token sale?

Token sales are an important part of the crypto ecosystem. Learn their ins and outs.

Bitcoin.com in your inbox

A weekly rundown of the news that matters, plus educational resources and updates on products & services that support economic freedom

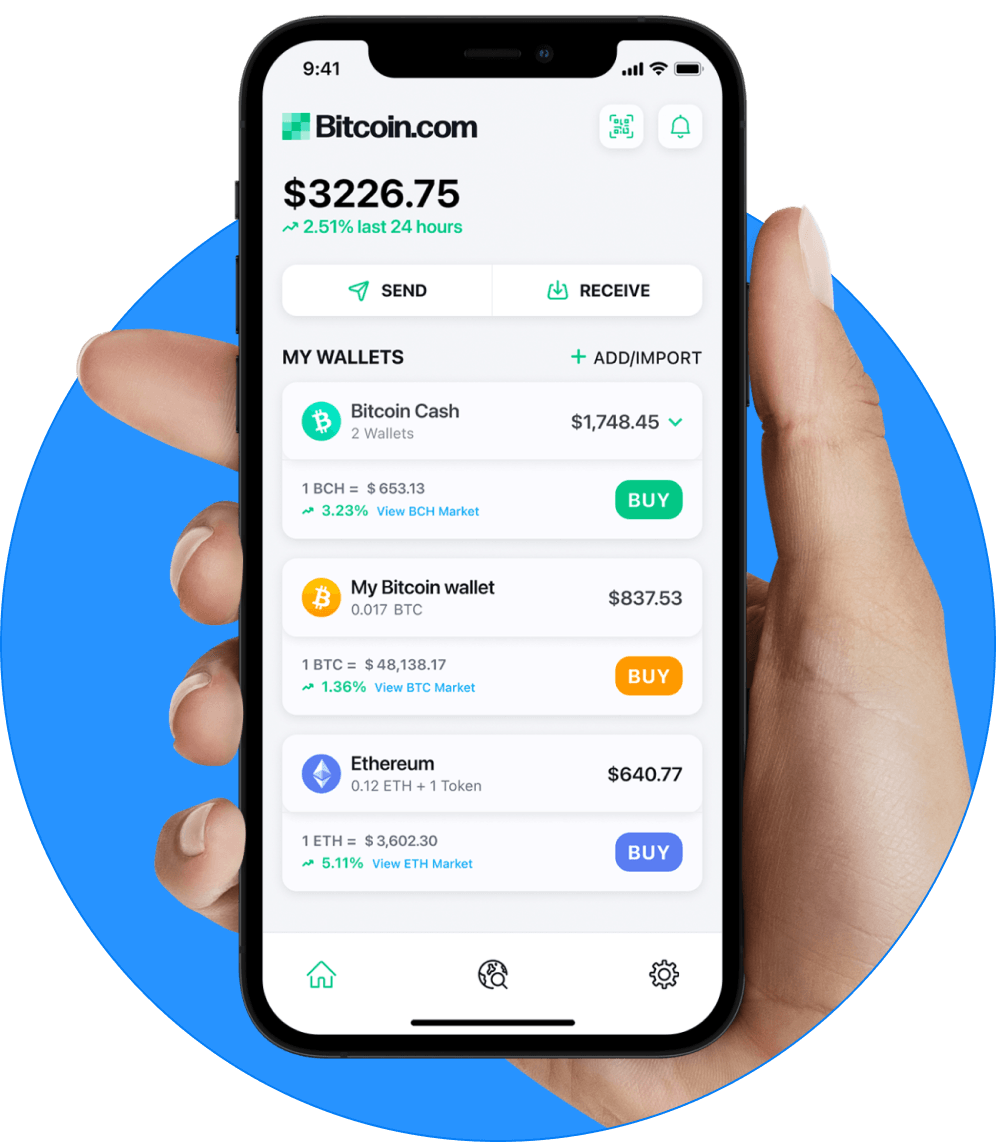

Start investing safely with the Bitcoin.com Wallet

Everything you need to buy, sell, trade, and invest your Bitcoin and cryptocurrency securely